Introduction

The Ethiopian investment legal landscape has been making fast-paced developments in the past three years and especially after the promulgation of the Investment Proclamation No. 1180/2020 (“Proclamation”). In particular, the investment incentives regime has shown such developments following the adoption of the Investment Incentives Regulation No. 517/2022 (“Regulation”). The Regulation mainly covers incentives applicable to new investments. With respect to incentives applicable to investment expansion or upgrading, the Regulation envisages the adoption of a directive by the Ministry of Finance (“Ministry”). Accordingly, the Ministry has recently issued a Directive to provide for the Application of Tax Incentives for Expansion or Upgrading No. 941/2023 (“Directive”).

This Legal Update provides an overview of the application of tax incentives for investment expansion or upgrading as laid down under the Directive.

Expansion or Upgrading: Meaning

Expansion or upgrading is defined under the Proclamation to incorporate the following: (a) increasing in volume of the existing enterprise by at least 50% of its attainable production or service rendering capacity; or (b) increasing in variety of the existing enterprise by at least 100% by introducing new production or service rendering line; or (c) increment by both.

The Directive requires the fulfillment of three elements for an expansion or upgrading investment to be eligible for income tax exemptions: achievement of volume and variety requirement; fulfillment of the eligibility conditions; and submission of audit report and maintenance of audit report.

Achievement of Volume and/or Variety Requirement

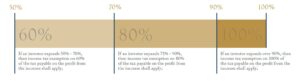

The Directive uses an existing investment as the benchmark to determine the utilization of incentives. In regards to expansion or upgrading that results from volume, the Directive stipulates that an investor expanding the production and service rendering capacity of an existing enterprise is eligible for income tax exemption as follows:

As can be referred from the above, the Directive has implemented a progressive approach whereby the income tax exemption privilege increases as the volume of production and service rendering capacity of an existing enterprise increases.

Unlike the increase in volume, the Directive states that an investor increasing its variety by at least 100%, upon introducing new production or service rendering line, is entitled to the income tax exemption provided under the Regulation’s schedule. As such, the investment expansion or upgrading in the context of variety should be 100% to benefit from income tax exemption.

In addition to the income tax exemption, the Directive provides for customs duty exemption for investment expansion or upgrading. In this regard, an investor is required to submit a business plan indicating its intention to meet criteria of expansion or upgrading through the introduction of new production or service rendering line on the existing enterprise. That said, investors can be eligible for customs duty exemption without fulfilling this requirement subject to an exceptional approval by the Ministry in situations where the goods to be imported for the expansion or upgrading are deemed to modernize the enterprise’s production process; increase productivity, type of production and/or service delivery.

Fulfillment of the Eligibility Conditions

The Directive has set out the conditions that need to be fulfilled for investors expanding or upgrading to become beneficiaries of the investment incentives. In this regard, the conditions enumerated on the Directive include the submission of evidence on matters such as the existing enterprise’s operations for at least 36 months; fulfillment of tax obligations particularly declaration of tax during tax exemption period, if any; contributions of the invested capital to modernize productions process, introduce new technology or increase the production or service type which has to be proved with an external auditor’s financial statement. These requirements imply the regulator’s intention for the strict application of incentives for the intended expansion or upgrading purposes.

Submission of Audit Report and Maintenance of Separate Books of Accounts

The Directive clearly stipulates that an investor shall maintain separate books of accounts for the investment expansion or upgrading. As such, separate books of accounts of an existing enterprise and an expansion or upgrading investment is required. In addition to keeping separate books of accounts, it is worth noting that the Directive requires investors to submit a financial statement from an external auditor to be entitled for incentives.

Concluding Remarks

The implications and opportunities of the Directive are yet to be tested. However, the Directive has put in place stringent requirements in the utilization of incentives in the context of investment expansion or upgrading. We expect that investors engaged in expansion or upgrading and declaring profits from such investments will be subject to high standards of scrutiny by the tax authority in relation to the amount of such profits. As such, investors are expected to carefully treat the relationship between their existing investments on the one hand and expansion or upgrading investment on the other hand especially in respect of keeping separate books of accounts.

Disclaimer

The information contained in this legal update is only for general information purposes. Nothing herein shall be considered and relied upon as a legal advice or a substitute thereto.